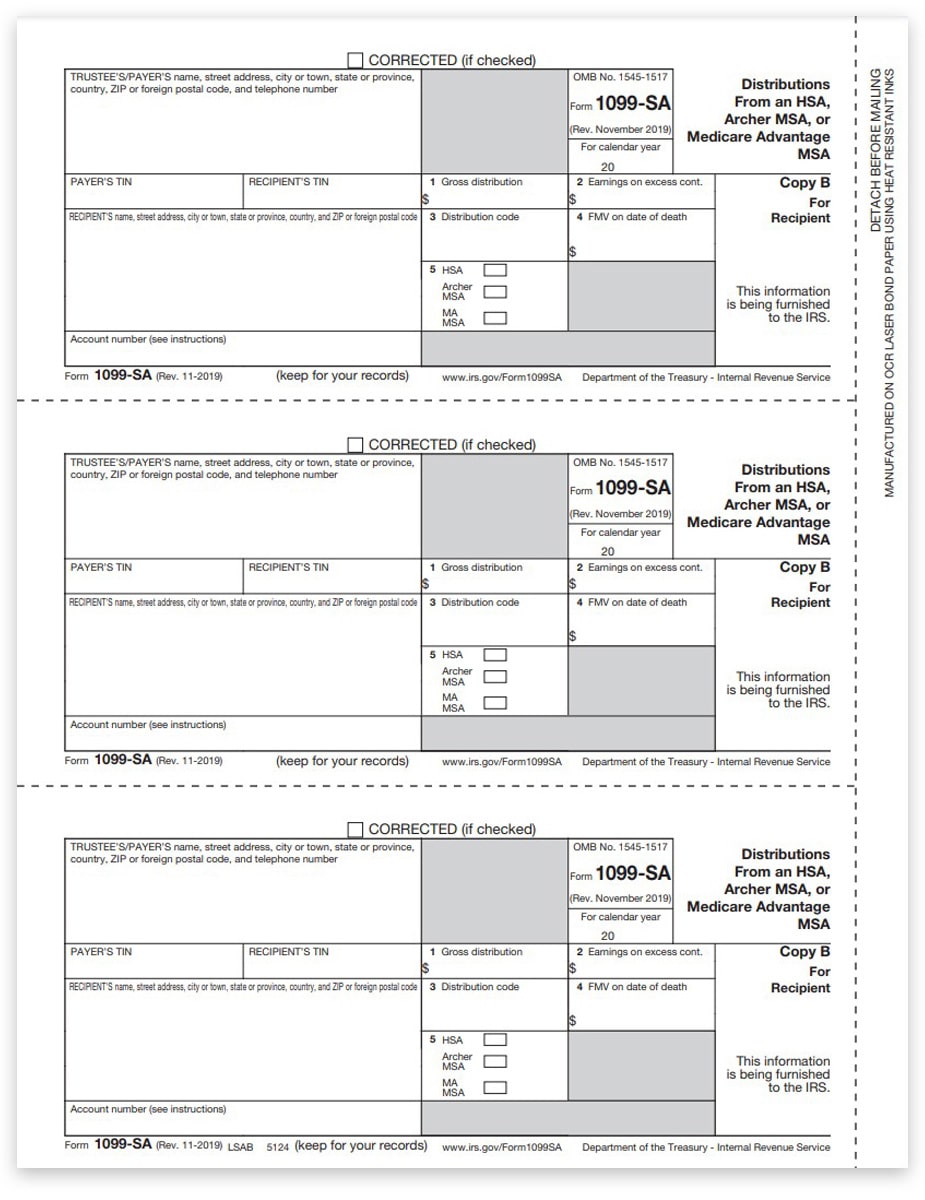

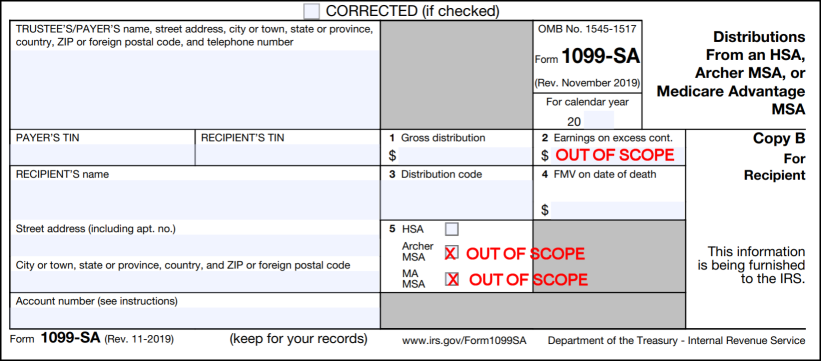

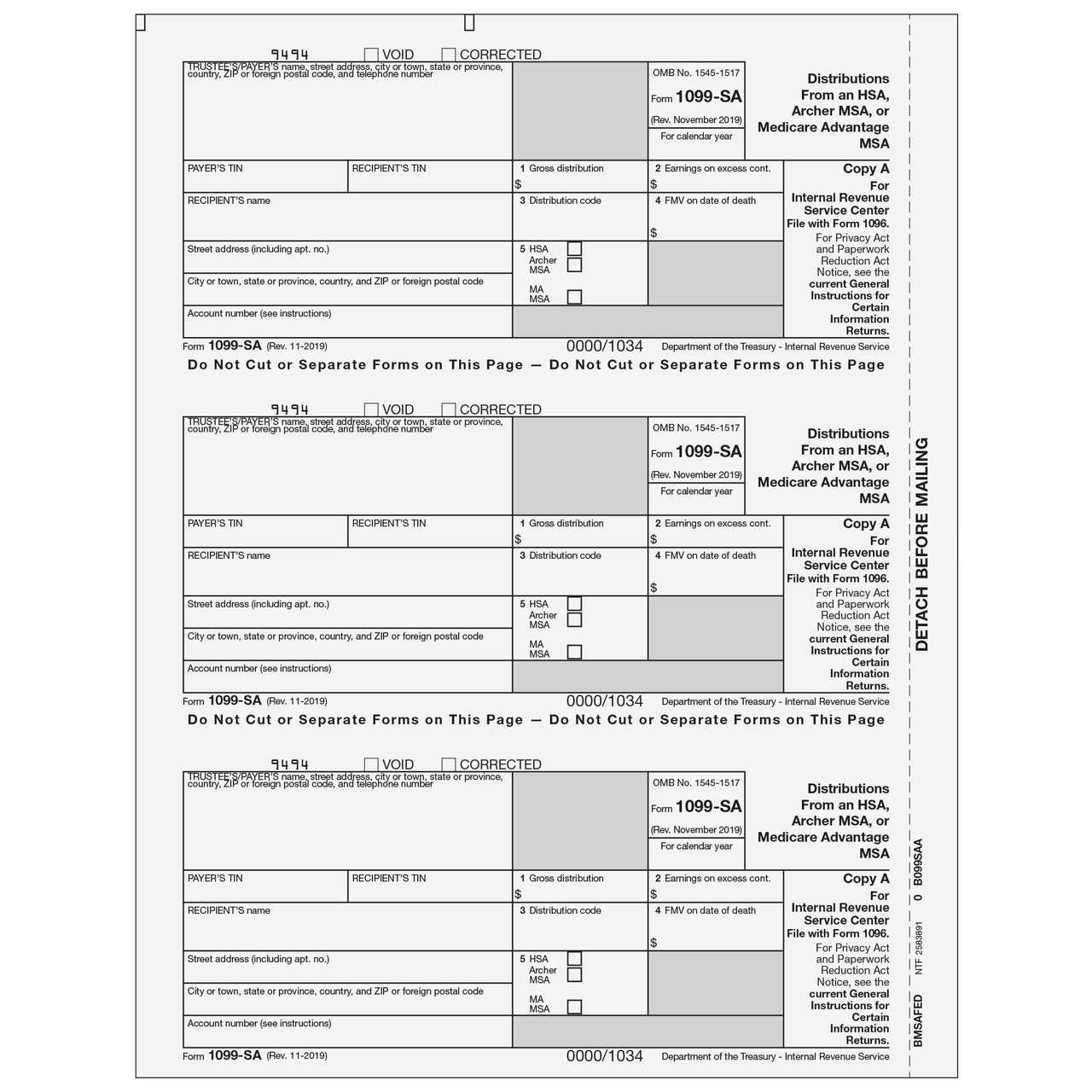

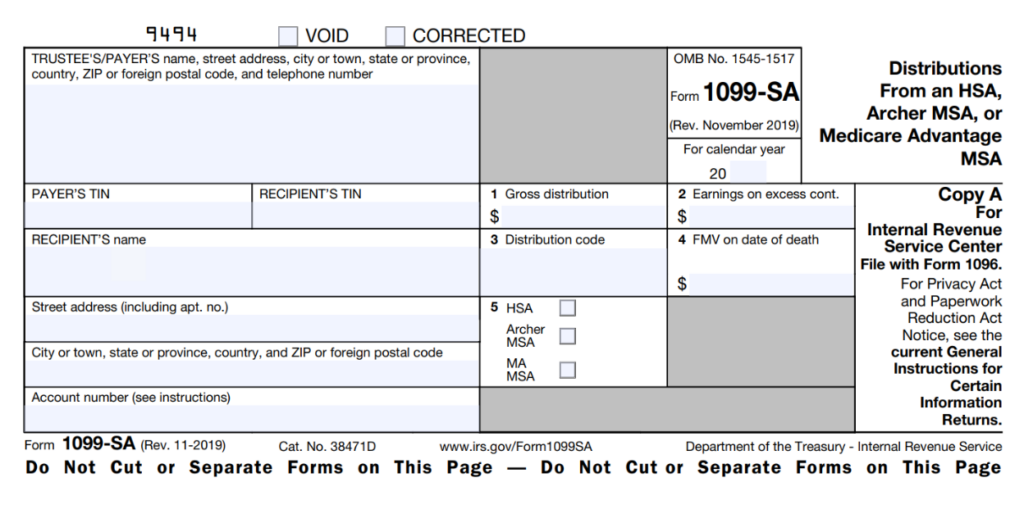

BMSAFED05 - Form 1099-SA Distributions from an HSA, Archer MSA, Or Medicare Advantage MSA - Copy A Federal - BrokerForms.com

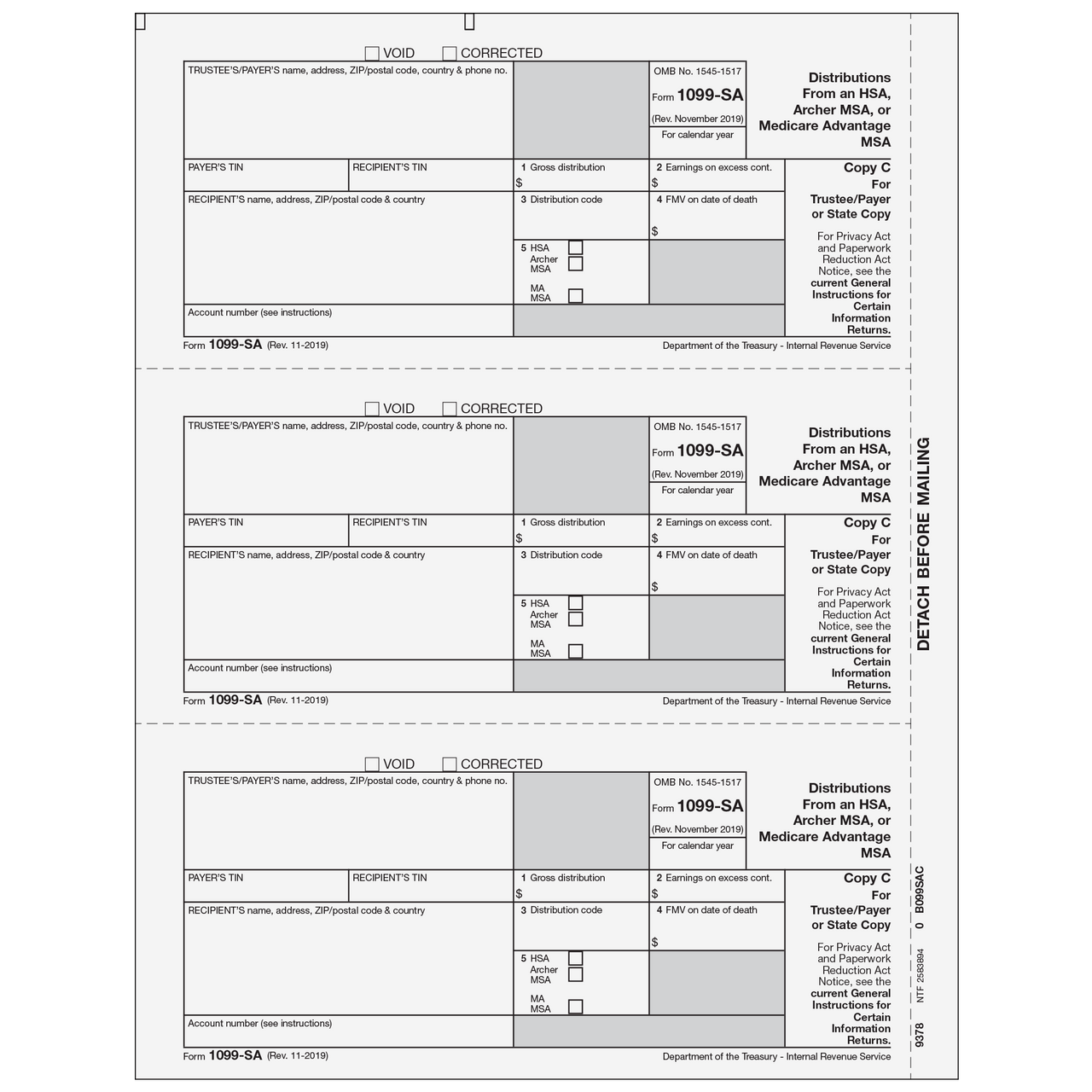

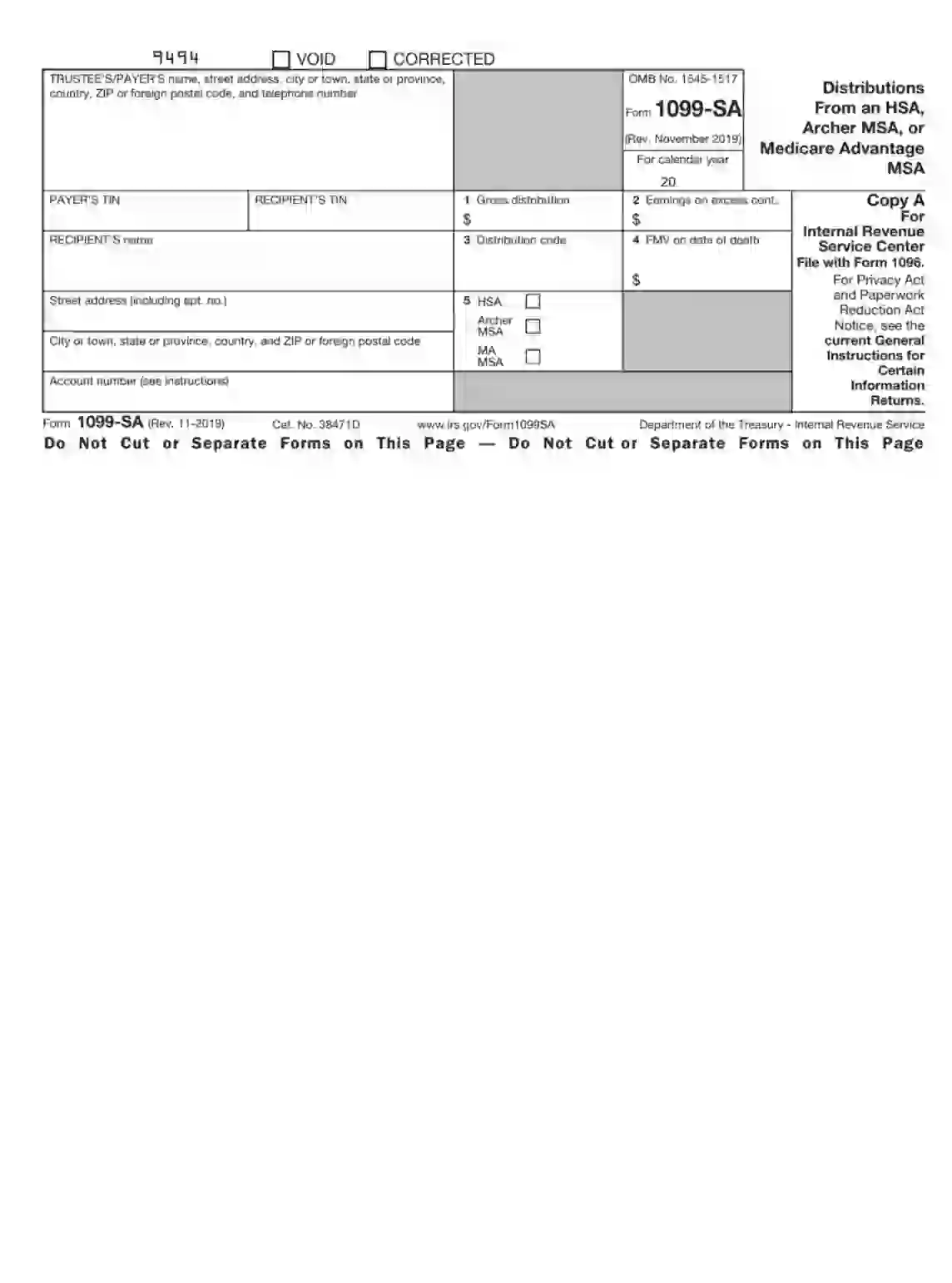

9378 - Form 1099-SA Distributions from an HSA, Archer MSA, Or Medicare Advantage MSA - Copy C Payer - NelcoSolutions.com

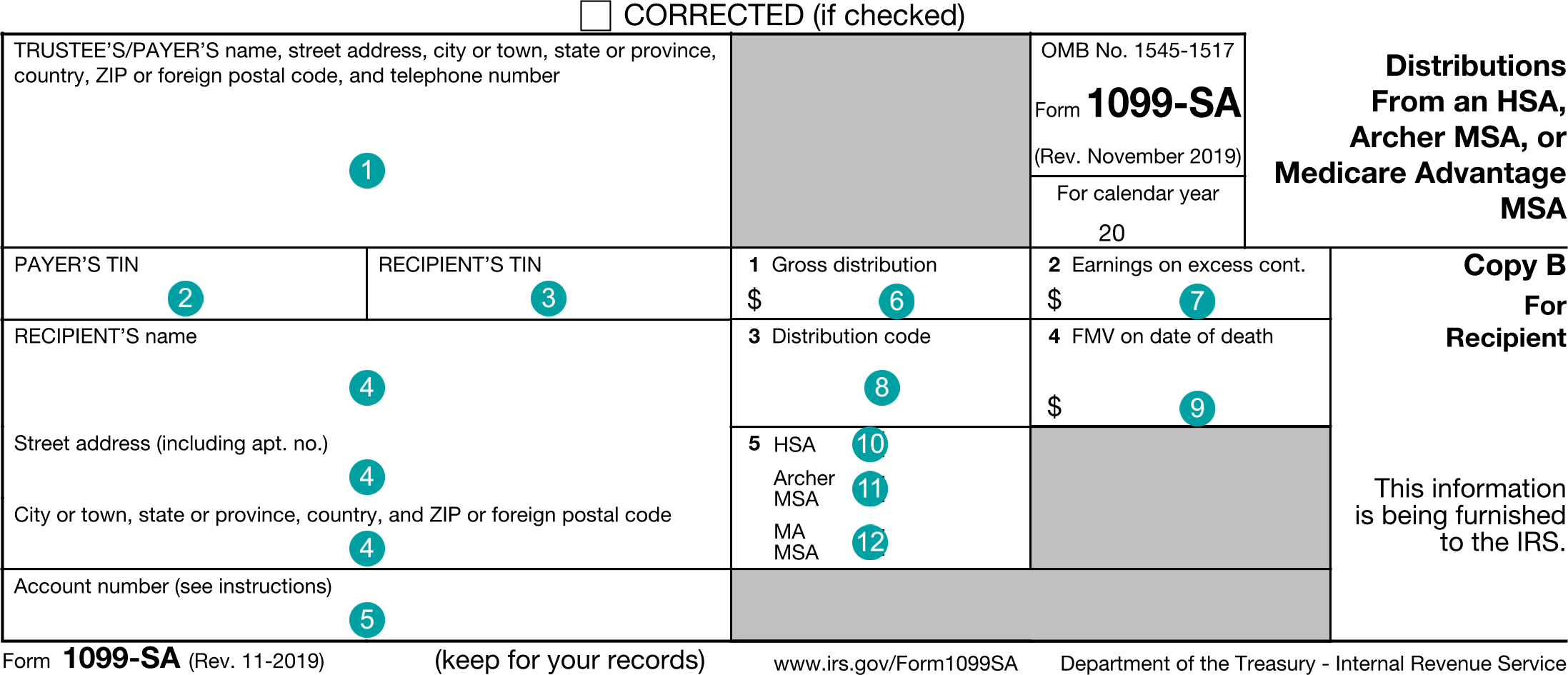

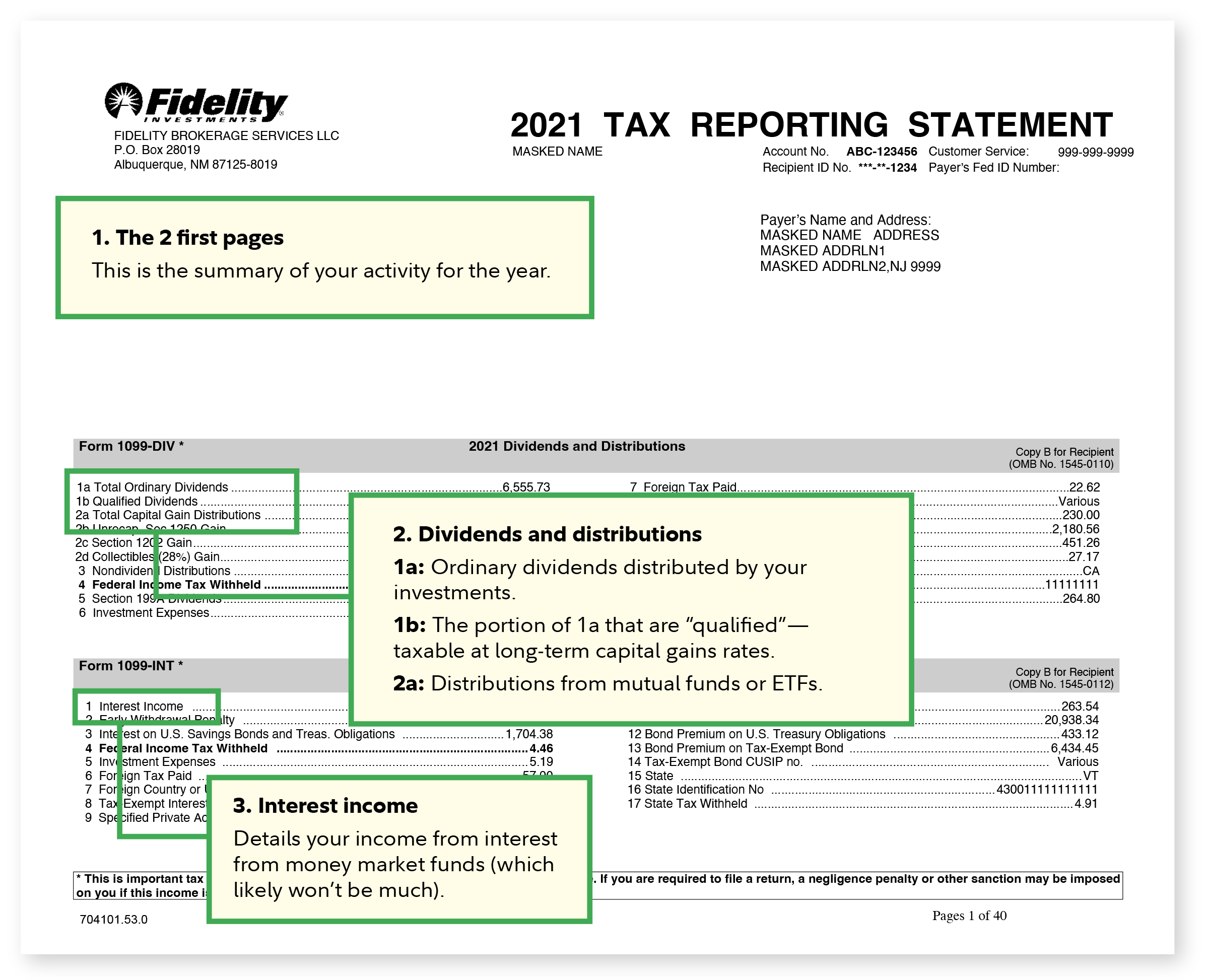

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)